The asset management platform for wealth and financial advisors, family offices and banks

With OWNLY Advisor, OWNLY FinTech GmbH offers a pioneering digital platform that has been specially developed for asset managers. Our solution enables comprehensive consolidation of assets to open up a new dimension of transparency and efficiency for you and your clients. Complex assets are presented clearly and comprehensibly so that you can offer your clients even more precise and targeted advice.

Experience the advantages of OWNLY Advisor and our innovative technology for a holistic overview and presentation of your clients’ asset statements. We offer the optimal solution for your requirements, also with individual extensions on request.

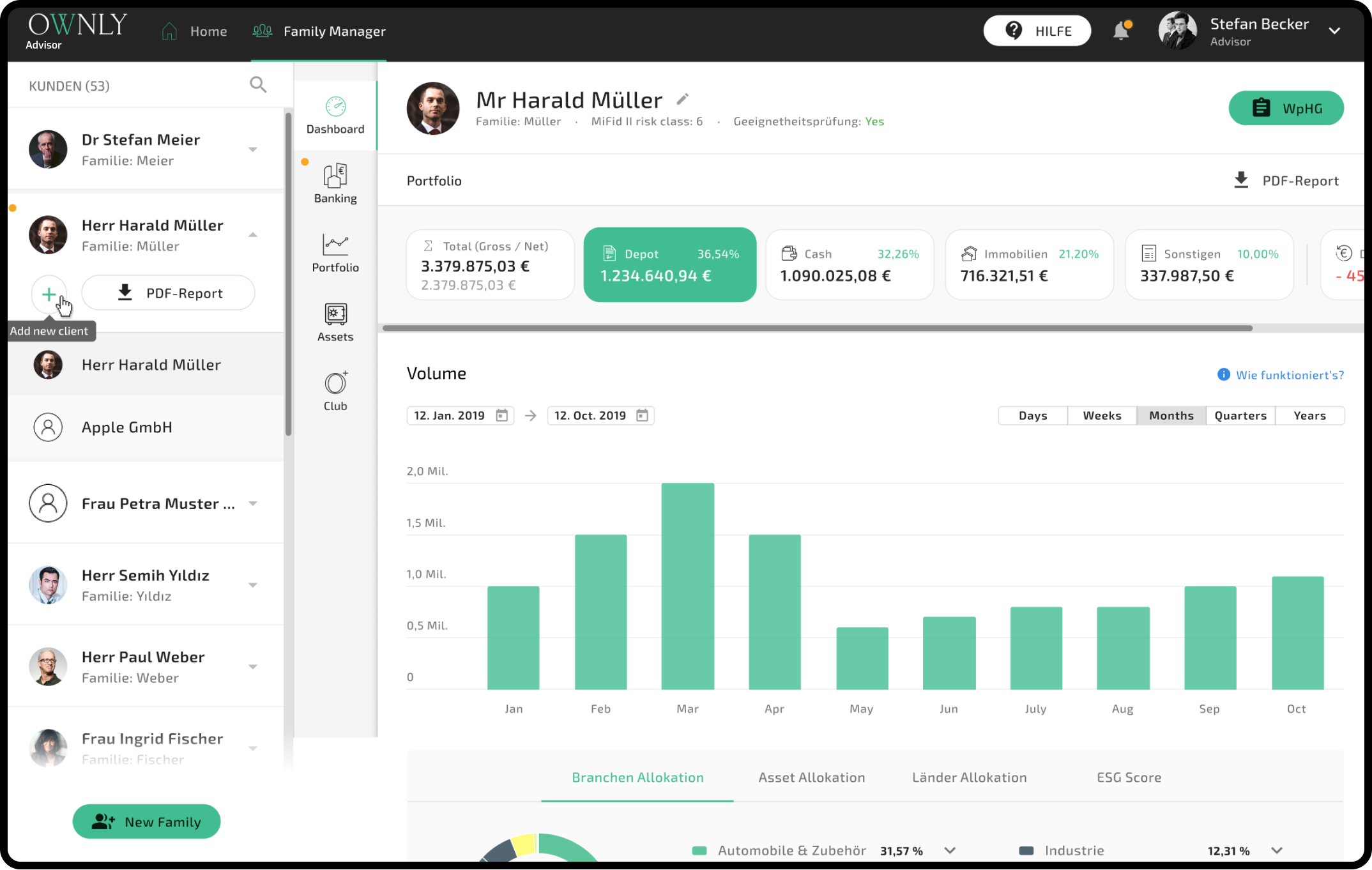

OWNLY Advisor supports you in managing your clients’ assets with powerful functions such as analyzing securities portfolios by sector, asset class or currency area. In addition, you can extend the platform individually, for example by implementing ESG scores or other specific features – according to your requirements.

Our team of highly qualified developers enables you to fully personalize dashboards and evaluations and program additional functions tailored to your needs. OWNLY Advisor remains flexible and grows with your requirements.

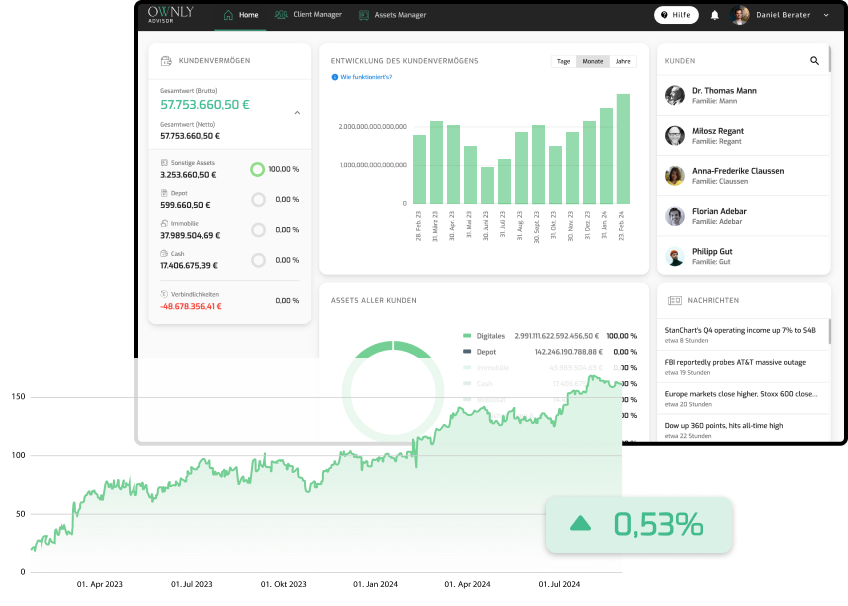

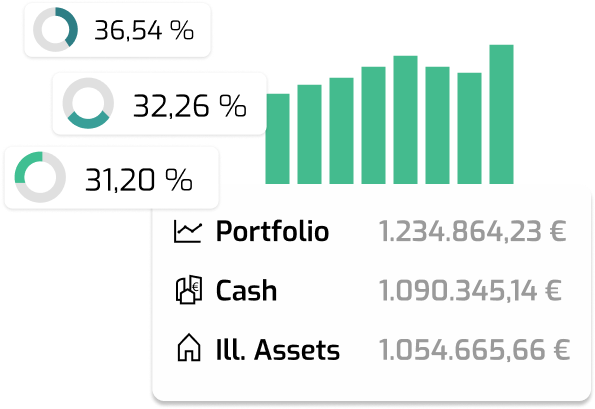

The performance and asset allocation of families, individuals and legal entities are visualized here simply and clearly. The dashboard gives you a comprehensive overview of all your clients.

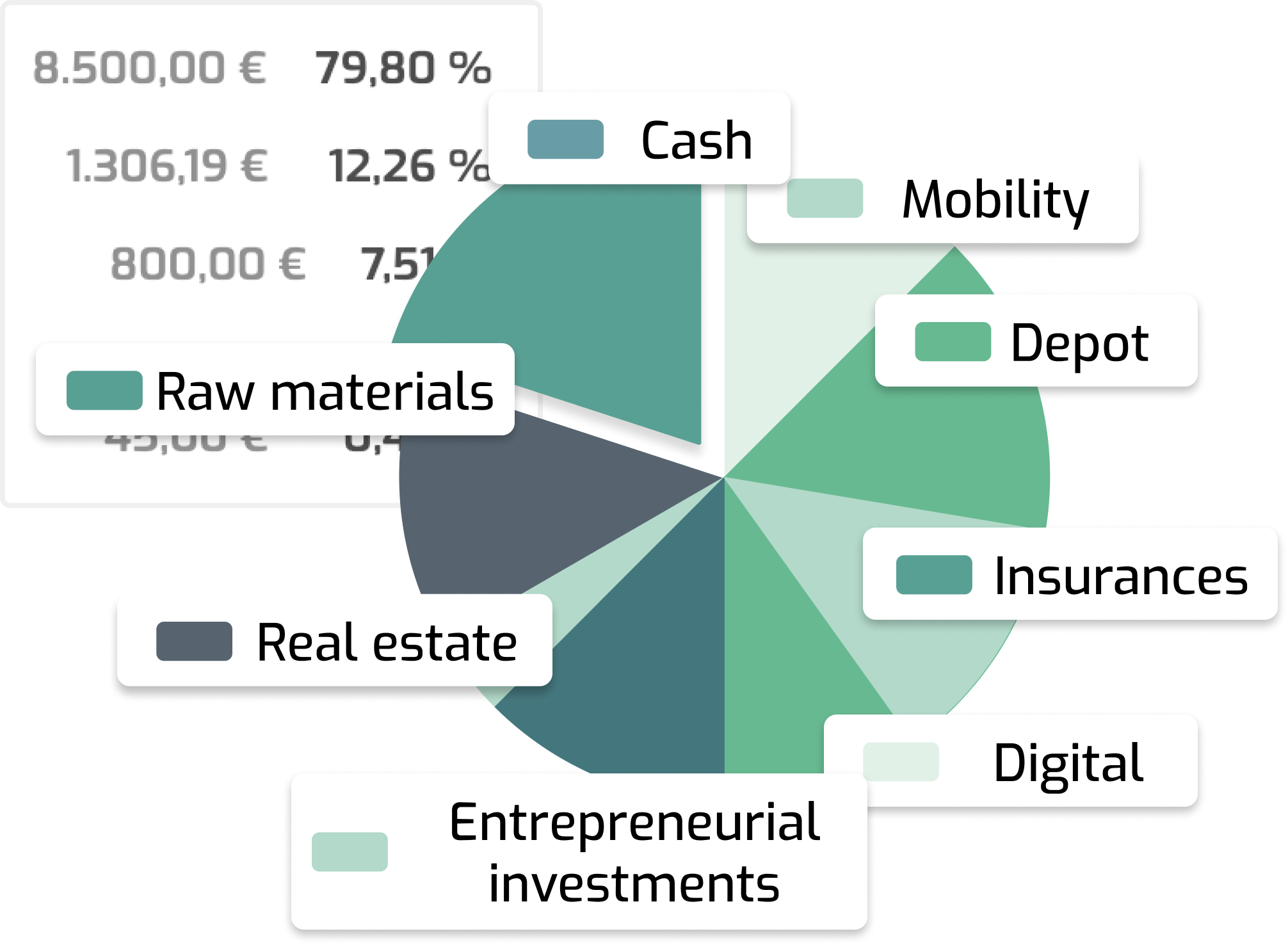

OWNLY Advisor offers comprehensive functions to present your clients’ assets transparently. By integrating data from bank accounts, custody accounts and illiquid assets such as real estate, vehicles, cryptocurrencies and other valuables, the software provides a holistic overview.

OWNLY Advisor facilitates the management of client assets through the ability to generate comprehensive reports at various levels. Whether at overall, family or individual client level, the export function enables simple PDF export for clear and concise wealth overviews.

OWNLY Advisor can be easily integrated into your corporate design as a white-label product to ensure a consistent brand presence. Customizations such as color schemes, logo integration and fonts ensure a seamless integration into your brand identity. This flexibility allows you to provide your customers with a professional, consistent user experience that reinforces your brand.

In addition, OWNLY Advisor not only helps you to manage existing assets, but also to attract new clients. Our software offers you innovative tools to convince prospective clients with interactive and personalized presentations of investment strategies. Attractive dashboards, clear evaluations and the ability to tailor the platform to specific client needs will help you build trust and stand out from the competition.

With OWNLY Advisor, you gain a solution that strengthens your brand, optimizes your advice and at the same time fully exploits the potential for acquiring new customers.

The best introduction to modern wealth management.

For family groups/single family offices and semi-professional investors

€ 500

€ 349

/month

Angebot gültig bis 30.04.2025

Total assets overview

Banking and depots

Asset reporting

Illiquid assets

Basic version with additional function modules.

For companies with end customer business.

from

€ 2500

/month

Asset allocation analysis

Performance calculation

Real estate dossiers (Pricehubble)

Document management

Individual B2B project

On request

We create your financial software according to your wishes on the basis of all the technologies used.

Your clients will receive a personal registration link from you, which will automatically add them to the responsible advisors. They can then add and manage their assets either alone or together with you.

With the “Advanced” plan, you can benefit from many individual extra modules such as the connection of ESG scores, a document manager or an extended real estate valuation. Please contact us for more information and arrange a demo appointment with us.

To add a bank account in OWNLY Family, first select the family member for whom the bank account is to be linked in the “Family Manager”.

Select the “Banking” menu item on the left and click on the “+” symbol at the bottom right.

Choose between the direct connection of your bank account via online banking (connection via a certified PSD2 interface) or the manual entry of account data.

If you connect your bank details directly, you will be asked for the bank sort code (BLZ) or the BIC. Select your bank to connect it in OWNLY Family. You will now be asked to authenticate yourself with your bank. This is usually done using Pin/Tan or the procedure provided by your bank when you log in.

To add a securities account connection in OWNLY Family, first select the family member for whom the securities account is to be connected in the “Family Manager”.

Select the “Banking” menu item on the left and click on the “+” symbol at the bottom right.

Choose between the direct connection of your custody account via online banking (connection via a BaFin-certified PSD2 interface) or the manual entry of custody account data.

If you connect your bank details directly, you will be asked for the bank sort code (BLZ) or the BIC. Select your bank to connect your custody account in OWNLY Family. You will now be asked to authenticate yourself at your bank. This is usually done using the Pin/Tan or the procedure provided by your bank when you log in.

OWNLY FinTech implements the highest standards of data security. All data is stored on a central, separate server in Hesse, which is operated exclusively in Germany. Neither OWNLY FinTech employees nor third parties have access to this data. For processing and analysis, OWNLY uses a German server provider that is certified to the highest security standards, ISO 27001 and BSI. Your personal data is encrypted throughout and protected by SSL standards during transmission. The data is stored exclusively for the period prescribed by law. As a customer, you also have the right to request the deletion of your data at any time.

We process your e-mail address, telephone number and your first and last name in order to respond to your inquiries. Passwords and account data are fully protected and cannot be viewed by anyone. If you lose your password, please use the password reset function. General user data is only evaluated anonymously in accordance with legal requirements. Personal data will only be passed on to third parties at the express request of the customer, for example when using the pass-on function for services in the OWNLY Club.

As a BaFin-regulated institution, OWNLY FinTech is legally obliged to carry out a one-off check of user data as part of the money laundering check during initial registration in order to rule out links to criminal organizations. Beyond this, no further checks of personal characteristics or information are carried out.

To add an asset in OWNLY Family, first select the family member for whom the valuation is to be carried out in the “Family Manager”.

Select the “Assets” menu item on the left and click on the “+” symbol at the bottom right.

Then select your desired asset and add all the required key data.

If you have any problems registering, logging in or using the web application, you can contact us by telephone on +49(40) 209 324 170. You are also welcome to contact us in writing at contact@ownly.de. You are also welcome to contact us if you have not received an invitation code by SMS.

OWNLY FinTech GmbH

Gertrudenstraße 9

20095 Hamburg

Mon – Thu from 9.00 a.m. to 5.00 p.m.

Friday from 9.00 a.m. to 3.00 p.m.

© 2024 OWNLY FinTech GmbH